Information and Resources

Understanding the differences between Title 32 Special Districts and HOA’s can be complex. The following links can offer clarity and provide you with additional resources and educational material.

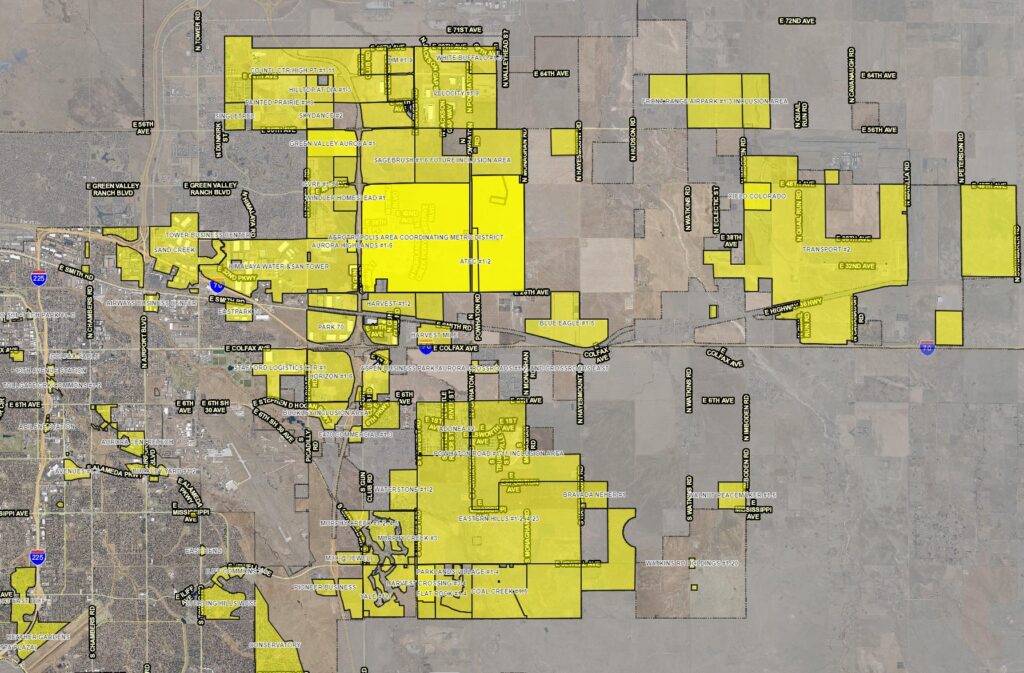

Metropolitan Districts

The following information is provided courtesy of McGeady, Becher, Cortese and Williams, pc, https://specialdistrictlaw.com/

What is a Metropolitan District?

A special district in Colorado is indeed a quasi-municipal corporation and a political subdivision of the state, created to provide specific public services or infrastructure that a county or municipality cannot or does not provide on its own. These districts are typically formed for the purposes of financing, installing, operating, and maintaining public infrastructure like roads, water and sewer systems, parks, fire protection, and more.

Special districts have the authority to levy taxes, issue bonds, and charge fees to fund these services. Since they are considered tax-exempt entities, they can provide financing mechanisms that allow for the upfront construction and maintenance of infrastructure without immediate tax burdens on residents, although taxes or fees are eventually collected to pay for the services and debt associated with the infrastructure.

Some examples of special districts include metropolitan districts, water and sanitation districts, and fire protection districts, among others. These entities often operate independently from local governments but are still subject to state laws and oversight.

What are examples of services Special Districts can provide?

The following list includes the types of services a special district can provide:

• Fire protection

• Mosquito control

• Parks and recreation

• Safety protection

• Sanitation

• Solid waste disposal facilities, or collection and transportation of solid waste

• Street improvements

• Television relay and translation

• Transportation

• Water

• Covenant enforcement & Design Review Services

What are the benefits of a Special District?

Fundraising through Municipal Bonds and Other Financing Mechanisms:

Special districts have the ability to issue municipal bonds to fund public infrastructure projects. Since they are considered governmental entities, they can benefit from lower interest rates and more favorable financing terms compared to private companies. This allows them to fund large-scale infrastructure projects like water treatment plants, roads, and other essential services that may be difficult for a municipality or county to finance on its own.

Tax Exemptions:

Special districts enjoy certain tax exemptions, such as exemptions from sales, use, and other taxes on purchases for equipment, supplies, and services. This lowers the operational costs for these districts and allows more resources to be directed toward the actual provision of services, rather than paying taxes on necessary materials.

Non-Profit Nature:

Special districts are created to provide public services, not to generate profits. Their financial operations are governed by statutes and regulations that ensure funds are used exclusively for public infrastructure, service delivery, or related purposes. This means any revenue generated (through taxes, fees, or bond sales) is reinvested in the services and maintenance of the infrastructure rather than distributed as profit.

Regulatory Oversight:

Special districts are subject to various state-imposed financial oversight measures, including annual audits, budget filings, and other reports. These requirements provide transparency and accountability, ensuring the district’s financial health is regularly monitored and that it operates in compliance with applicable laws and regulations.

Local Control and Accountability:

One of the key advantages of special districts is their local governance structure. Special districts are often governed by a board of directors elected by the local community or property owners. The district is accountable to the public, with decisions made at regular public meetings and subject to community input through public hearings and elections. This structure allows special districts to be more responsive to the unique needs and priorities of the local community.

Governmental Immunity:

Special districts enjoy a degree of legal immunity under Colorado law, which protects them from certain lawsuits that could result in expensive legal fees or settlements. This immunity helps avoid the financial burden of litigation, ensuring that tax or fee rates do not have to be raised to cover legal costs, as might happen with private entities facing such challenges.

Local Focus and Responsiveness:

Because special districts are focused on specific services in a defined geographic area, they can be more nimble and better able to respond to the needs of the local community. Unlike larger municipalities or counties that may have broader or more generalized concerns, special districts can prioritize and tailor services directly to the community they serve, making them more effective at addressing localized issues.

In summary, special districts offer a range of benefits, including financial advantages, local control, regulatory oversight, and operational efficiencies. These features allow special districts to provide important services and infrastructure in a way that is both responsive to the local community and cost-effective.

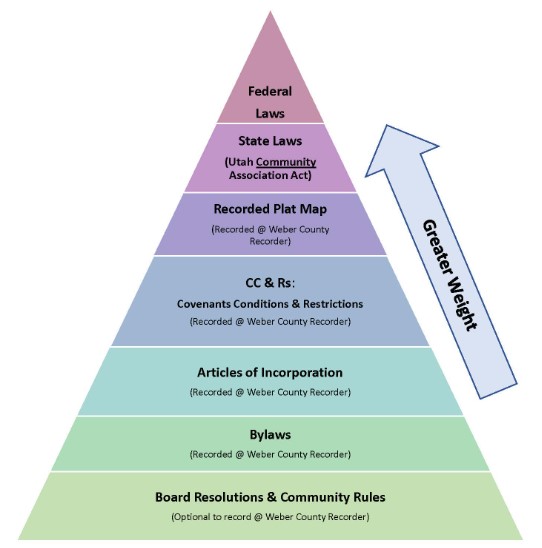

How are Title 32 Districts different from Homeowners Associations?

A special district has significantly broader powers than a homeowners association (“HOA”), including the power to impose property taxes, and other fees and charges. Although an HOA is normally responsible for the maintenance and operation of some improvements within a development, it may assess dues to its members but has no ability to impose taxes. A special district uses property taxes and fees and charges to pay for its services. Unlike HOA fees, property taxes are tax deductible and collected by the County.

Homeowners Associations

What is a Common Interest Community also known as an HOA?

A homeowners association (“HOA”) or Common Interest Community, (“CIC”) as further defined under the Colorado Common Interest Ownership Act (“CCIOA”) is a not-for-profit private corporation established in order to provide maintenance for common elements, protect property values through restrictive covenants, and collect assessments from owners to operate the HOA.

There are three general types of HOAs:

Cooperative – each owner owns a share in the corporation. Example: high rise building.

Planned Unit Development (“PUD”) – the HOA owns the common areas of the community.

Condominium – each owner owns a percentage of the common area as defined in the Declaration of Covenants. Typically exterior maintenance of the homes is included in a Condominium HOA.

What are examples of services Homeowner Associations can provide?

The following includes the types of services a special Associations can provide:

• Covenant Control

• Design Review

• Reserve Funding

• Fee Collection

• Special Assessment for Budget Deficits

What information must an Association disclose?

The Colorado Common Interest Ownership Act requires common interest communities to disclose the below information to their membership within 90 days after the end of each fiscal year. This is often referred to as the annual disclosure.

• Name of the association;

• Name of the association’s designated agent or management company, if any;

• Valid physical address and telephone number for both the association and designated agent or management company, if any;

• Name of the common interest community;

• The initial date of the recording of the declaration and the reception number or book and page for the declaration;

• The date on which the association’s fiscal year commences;

• The association’s operating budget for the current fiscal year;

• A list, by type, of the association’s current assessments – including regular and special assessments;

• The association’s annual financial statements, including any amounts held in reserve for the fiscal year immediately preceding the annual disclosure;

• The results of the association’s most recent available financial audit or review;

• A list of all association insurance policies, including, but not limited to property, general liability, association director and officer professional liability, and fidelity policies. This list must also include the company names, policy limits, policy deductibles, additional named insureds, and expiration dates of the policies listed;

• The association’s Bylaws, Articles of Incorporation, Rules & Regulations;

• The Minutes of the Executive Board and Membership Meetings for the fiscal year immediately preceding the current annual disclosure; and

• The association’s Responsible Governance Policies adopted pursuant to section 38-33.3-209.5 of The Colorado Common Interest Ownership Act.

Associations must make the information above available to its members at no additional cost to unit owners and may do so by one of the following ways:

• Posting on an internet web page with accompanying notice of the web address sent via first-class mail or email to all owners;

• The maintenance of a literature table or binder at the association’s principal place of business; or

• Mail or personal delivery to all owners.

The costs associated with these methods of delivery and making the disclosures available shall be accounted for as a common expense liability of the association.

Education and Resources